[FRIDAYS BELL AND END OF THE WEEK]

2 minutes until close on an excellent day all around the FTSE from what I see. It's closed at 6052, after being given an injection of bull juice at 10 this morning. Just want to focus on 3 stocks today - ReneSola, SIG and Berkeley Group.

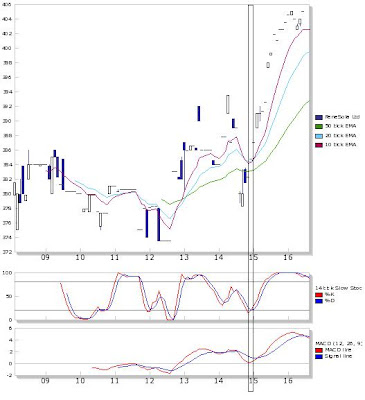

Think I've mentioned them all in the past 2 posts, but we've seen some good movement today. SOLA is a stock that just amazes me with it's intra-day movements. It was languishing at about 377p when I got back from college today, and literally just as I sat down, I noticed 2 green flashes and checked out the market depth. It was looking pretty strong to say the least.

Anyway, it just legged it up to yesterdays closing at 402p after being down 5% earlier in the day. It's probably about the 3rd time I've seen SOLA do this on intra-day. Here's a visual. I sat down at the box and watched it do it's thing - damning, yet again, my lack of available money.

SHI, a midweek purchase and subject of yesterdays post, broke the short term resistance from the chart I posted yesterday. It was up 2.3%, but seems to be subject to heavy support from the FTSE for it's movements, so I'm not putting its gains down to my TA at all - I just think the mood in the market was buoyant today.

SHI, a midweek purchase and subject of yesterdays post, broke the short term resistance from the chart I posted yesterday. It was up 2.3%, but seems to be subject to heavy support from the FTSE for it's movements, so I'm not putting its gains down to my TA at all - I just think the mood in the market was buoyant today.

There is also some strong looking indicators on the stochastics and MACD, both have taken a turn, and the stochastics are +20 in the zone so I'm feeling good about SHI for the moment.

There is also some strong looking indicators on the stochastics and MACD, both have taken a turn, and the stochastics are +20 in the zone so I'm feeling good about SHI for the moment.

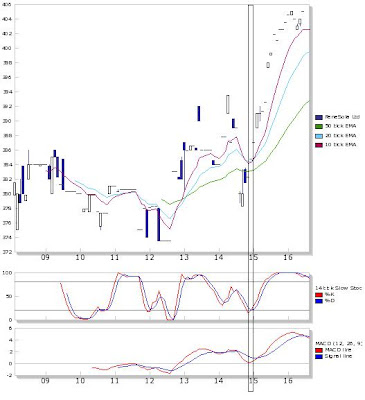

A follow-up from yesterday on BKG. My early indications from yesterdays TA were buy at yesterdays price. The stock was up 5% today, but, like SHI, I think a lot of the movement was based on the RSI - even though it's movement outperformed most of the other stocks I was looking at.

Early indicators say run with this - it's nearly on both supports and has just seen the earliest signs of a price reversal, going by the stochastics only. I think there might still be a little bit to go on the downside, maybe by the end of Tuesday we will have a stronger indication of the reversal up to the resistance. On quick inspection there is a slight hint of negative divergence on the MACD on recent lows.

Early indicators say run with this - it's nearly on both supports and has just seen the earliest signs of a price reversal, going by the stochastics only. I think there might still be a little bit to go on the downside, maybe by the end of Tuesday we will have a stronger indication of the reversal up to the resistance. On quick inspection there is a slight hint of negative divergence on the MACD on recent lows.

Think I've mentioned them all in the past 2 posts, but we've seen some good movement today. SOLA is a stock that just amazes me with it's intra-day movements. It was languishing at about 377p when I got back from college today, and literally just as I sat down, I noticed 2 green flashes and checked out the market depth. It was looking pretty strong to say the least.

Anyway, it just legged it up to yesterdays closing at 402p after being down 5% earlier in the day. It's probably about the 3rd time I've seen SOLA do this on intra-day. Here's a visual. I sat down at the box and watched it do it's thing - damning, yet again, my lack of available money.

SHI, a midweek purchase and subject of yesterdays post, broke the short term resistance from the chart I posted yesterday. It was up 2.3%, but seems to be subject to heavy support from the FTSE for it's movements, so I'm not putting its gains down to my TA at all - I just think the mood in the market was buoyant today.

SHI, a midweek purchase and subject of yesterdays post, broke the short term resistance from the chart I posted yesterday. It was up 2.3%, but seems to be subject to heavy support from the FTSE for it's movements, so I'm not putting its gains down to my TA at all - I just think the mood in the market was buoyant today. There is also some strong looking indicators on the stochastics and MACD, both have taken a turn, and the stochastics are +20 in the zone so I'm feeling good about SHI for the moment.

There is also some strong looking indicators on the stochastics and MACD, both have taken a turn, and the stochastics are +20 in the zone so I'm feeling good about SHI for the moment.A follow-up from yesterday on BKG. My early indications from yesterdays TA were buy at yesterdays price. The stock was up 5% today, but, like SHI, I think a lot of the movement was based on the RSI - even though it's movement outperformed most of the other stocks I was looking at.

Early indicators say run with this - it's nearly on both supports and has just seen the earliest signs of a price reversal, going by the stochastics only. I think there might still be a little bit to go on the downside, maybe by the end of Tuesday we will have a stronger indication of the reversal up to the resistance. On quick inspection there is a slight hint of negative divergence on the MACD on recent lows.

Early indicators say run with this - it's nearly on both supports and has just seen the earliest signs of a price reversal, going by the stochastics only. I think there might still be a little bit to go on the downside, maybe by the end of Tuesday we will have a stronger indication of the reversal up to the resistance. On quick inspection there is a slight hint of negative divergence on the MACD on recent lows.

0 comments:

Post a Comment