[HOLIDAY]

Getting some sun over the Christmas break. Will be back trading (and blogging properly) again in early January.

Ho ho ho.

Ho ho ho.

Trade a straight forward channel on the TSO chart:

Trade a straight forward channel on the TSO chart:

Increase your petrol money by spotting the easy S break trades and tops in RIG:

Increase your petrol money by spotting the easy S break trades and tops in RIG: Trade a magnitude of consecutive bear flags and 20ema retracements as your marvel at the low price in GM these days:

Trade a magnitude of consecutive bear flags and 20ema retracements as your marvel at the low price in GM these days:

On a side note: I'm quite getting into the CMC charting package now, it's actually alright. But don't tell them I said that.

On a side note: I'm quite getting into the CMC charting package now, it's actually alright. But don't tell them I said that.

In total with those trades a trader on their game could have traded for about 400 points up until right now. Even a slow trader being timid realistically could have slow-played for 200 points today on the FTSE with relatively low risk setups.

In total with those trades a trader on their game could have traded for about 400 points up until right now. Even a slow trader being timid realistically could have slow-played for 200 points today on the FTSE with relatively low risk setups. BAC hit target 1 today and was 10 cents off target 2. Looking at it now you can see a clear ascending triangle forming, as well as a potential ascending channel upon breakout of that formation. However BAC is hard work to trade therefore it would be wise to trade the retracement rather than the breakout.

BAC hit target 1 today and was 10 cents off target 2. Looking at it now you can see a clear ascending triangle forming, as well as a potential ascending channel upon breakout of that formation. However BAC is hard work to trade therefore it would be wise to trade the retracement rather than the breakout.

Slaughter.

Slaughter.

The ratio is the risk:reward calculation. The system also predicts what it thinks the outcome will be, this is based on:

The ratio is the risk:reward calculation. The system also predicts what it thinks the outcome will be, this is based on:

Outcome (with sample data):

Outcome (with sample data):

As you can see, this series of higher highs and higher lows has moved nicely after the SP dropped below price targets and formed a nice double bottom.

As you can see, this series of higher highs and higher lows has moved nicely after the SP dropped below price targets and formed a nice double bottom.

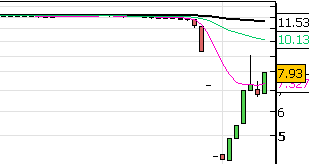

Rumour has it they are about to go bankrupt.

Rumour has it they are about to go bankrupt.

A little bored this week, so just been scanning some UK charts - something I don't do much these days.

A little bored this week, so just been scanning some UK charts - something I don't do much these days. Long on a break of 1400 though, and anticipate the retest. The 200EMA is not on this chart, and is currently at 1445, so perhaps take profits at this price if it breaks.

Long on a break of 1400 though, and anticipate the retest. The 200EMA is not on this chart, and is currently at 1445, so perhaps take profits at this price if it breaks.

Missed the double top because I was just getting back from college. Blatant sell signal seeing how it was also a touch on the downward trendline. I went long looking for a supportive 200MA (not on chart), but it failed and I bailed out. Good exit because it crashed again. Really should not have entered on the 200MA given the lack of a definitive short term trend.

Missed the double top because I was just getting back from college. Blatant sell signal seeing how it was also a touch on the downward trendline. I went long looking for a supportive 200MA (not on chart), but it failed and I bailed out. Good exit because it crashed again. Really should not have entered on the 200MA given the lack of a definitive short term trend.

That's only on 4 S&P contracts, and is only pennies. But that's another lie from CMC. They should really say they are "Nearly commission free, but not quite".

That's only on 4 S&P contracts, and is only pennies. But that's another lie from CMC. They should really say they are "Nearly commission free, but not quite".

I am not waiting for signs of this topping here, as this is actually a triple top not just a double.

I am not waiting for signs of this topping here, as this is actually a triple top not just a double.

I took an early exit from the trade for a confidence boosting profit. I didn't expect that rally at all, and although I believe GM will climb higher, I've got to have a celebration today to get over last week.

I took an early exit from the trade for a confidence boosting profit. I didn't expect that rally at all, and although I believe GM will climb higher, I've got to have a celebration today to get over last week.

Nice bounce off previous resistance and moving average for a better than expected rally. Textbook measured move on the failure of support too as it forms a tilting head and shoulders formation.

Nice bounce off previous resistance and moving average for a better than expected rally. Textbook measured move on the failure of support too as it forms a tilting head and shoulders formation.