Posted on 3/28/2008 12:16:00 pm

Friday mornings come around fast, and this far it's been a fairly decent week across my portfolio and watchlist. First things first my current stocks:

SEO

Another rollercoaster week from the Bio boys, it attempted to replicate it's movement of 2 weeks past with some excellent surges on Wednesday and Thursday (18%/22%). At it's peak it kissed .9 which represented a decent opportunity to get out for a loss of around £300 - half of what is was on Tuesday.

Not really sure what's causing the ramp - the lead up to the AGM and trading statement are my guesses. Yet again there are numerous debates about this biodegradable plastics lark on BBC and other media outlets so maybe the tables are turning in favour of SEO. However, a group of entrepreneurs from a local primary school up the road bought in cloth bags, stuck the schools logo on it and sold them all within a space of an hour...

So really, are bioplastic bags really that good when there are cotton/cloth bags around that look nice and are stronger? The investors in SEO should be looking to alternative uses for the bioplastic technology rather than plastic bags. Below is the rollercoaster chart that is SEO!

RWA

Well, this is a capital preservation with small growth trade and it's doing exactly that. It just ticks upwards at 0.5-1.75% a day and could realistically go unchallenged until 350p. A few investment firms getting into RWA at the moment too which is a good sign.

DES

Trading range for this is very small, and I've been sitting at even more or less since I bought it. Waiting for the news about farm-in etc so it's an exciting non-mover. FOGL, RKH and BOR also in the Falkland Isle oil game so prosperous times ahead - potentially. Had a though of putting £400 into each and leaving them for a year.

SEY

This sale is on sale right now IMO - lots of potential just apparent funding issues. Gas find and revenues coming from that in the past month so potentially a 50% gainer in the next few weeks but I'll be sitting tight on this.

Shortlist watch:

SFR up 10% today

SOLA was down 11% this morning, I've watched it climb back up to 2% blue

ROC up 8% today

Strong gains on Tuesday across the watchlist ranging from 26%-4%

I've also started watching HAWK and WLW - it's annoying being tied up in other stocks and it's something I'm coming to dislike strongly!

Posted on 3/23/2008 11:35:00 pm

Fit likey?

Not much happening stock wise at the moment. I'm waiting for RWA, DES and SEY to net me some profit so I can book a holiday this summer. SEO contiunues to be indecisive. I've got some good news on my watchlist in TLW, OEX and SFR (again!) so if there's a quick and easy profit to be made my next moves lie in those stocks.

I've gone back to SNG tournaments on poker and I'm doing quite well in those so far. It's really just a question of sitting back waiting for a premium hand - and I mean ultrapremium. It's not an easy way to make a living on the small stakes but I'm looking for growth in the bankroll.

Easter weekend means the markets are closed so really not much else to say.

Posted on 3/15/2008 01:17:00 pm

SEOs results were out on Friday - no positive movement on the share price though - it's gone down quite a bit. However, looking at the final years results and the interims from last year, their position has significantly changed for the better and it looks like a solid long term investment. There are still a few things to iron out, mostly with their patents, but it's in good stead for the coming years. Obviously I have to gear to long term now, my average price is significantly higher than the current price.

The interims in 6 months time should show some much stronger figures on last year. The plastic bag debate and the budget didn't give it the massive spin I'd hoped for, but oh well.

I bought small into SEY and RWA yesterday. Stirling Energy has been on the watchlist for a while, and it finally gave a buy indication on Friday. I will wait with baited breath on Monday as to whether there is any confirmation. It looks cheap at these rates, and hopefully it climbs over 12p next week. My average cost is 9.661.

RWA is one I have been looking at for a while now. Another small holding at avg of 181.30 (Broker fees are so bad with small holdings!) with some medium term potential. Not expecting much profit or sudden movement here, it's just nice to not have something so volatile in my portfolio for a change.

Bandwagon central this week I guess, bought DES about 2 weeks after I should have. There is a lot of continued talk about the papers about the falkland oil fields at the moment. DES looks to have steadied itself in its current range so bought this on the off chance they strike oil. Will hold until 2008. For the medium term I am expecting downward movement to as low as 40p.

Portfolio now:

- DES long term

- SEO long term

- RWA medium term

- SEY short term

- Bonds (snooze)

Overall right now I'm down 25% (SEOs fault!). Looking for steady rises from RWA and SEY with DES too longer. I will wait for the SEO AGM and see what comes from there before contemplating a change of strategy.

Posted on 3/11/2008 04:01:00 pm

What a game this is. Sold ASG after doing some research about it - all the positive rumours were completely unrelated to ASG, they were for rival company VMG. I sold out for a a near sizeable loss then watched as the shares dropped a further 30% this morning. It was a case of history repeating itself for this share, as 3 times in the last 6 months this happened. Anyway I have learned:

- Don't ramp a share

- Don't buy a share with such a small market cap

- Dump a ramped share as early as possible

- Research, research, research!

- ASG is a dog, despite what the others on the BB think!

I've finally bought into DES. This was a share I clocked onto early in my campaign at about 35p - it rocketed up to around the 85p mark before slipping back just a little. Missing the ramp allowed me to sit back and see how it all developed. Some may have jumped on hoping for a continued rise, but I wanted to see if it would consolidate it's position of +70p. It has done so and is steadily ticking upwards so I'm in with a small holding at 73.25p.

Not sure what to expect with this in the short term, some steady gains I hope. It all hinges on a Falklan oil farm, and the news from there looks positive. It also doesn't hurt that oil ticked US$108 today either.

As for SEO the longer I hold, the better I feel. It's been really steady the past 2 days and the lead up to Friday I expect it to do the same. It's over .90 now which was proving to be a resistance mark. Short term (>2 weeks) I'm looking to break even with continued gains past a medium term position. You can already see the difference and recovery in the portfolio as of this afternoon:

I am down quite a bit at the moment not including this, but I'm hoping for the grass to be greener on next weeks meadow. I have learned a lot in the past week which puts me in good stead for the future. I will post golden rules as a reference for myself at some point - starting with 1) Research the stock thoroughly.

I am down quite a bit at the moment not including this, but I'm hoping for the grass to be greener on next weeks meadow. I have learned a lot in the past week which puts me in good stead for the future. I will post golden rules as a reference for myself at some point - starting with 1) Research the stock thoroughly.

As for the rest of my watchlist I continue to be enamoured with RIFT oil, it looks like a terrific prospect, and the chart is highly suited for day trading. I will watch that for the next 2 weeks as my capital is employed in SEO and DES for at least that period of time, probably more. RWA, CLI and KLR also have the appearance of money makers.

A lot of my RIFT appreciation is built on a conversation I had with a fellow who works for a company involved with some subsea mineral exploration off the Papau New Guinea coast. The plumes that rise from the highly volcanic geography are full of near pure resources that almost eliminate feasibility studies because of their purity. It's one to watch - even though RIFT are land based there - the impact on the PNG economy could be huge. There are a raft of companies out there at the moment, and politically it seems to have stabilised a little lately.

Further to my SEO research - how good a prospect is the leading biogradable polymer company looking? So good, too good lol. In a business world that is increasingly pursuaded by consumers to be more green, Stanelco can potentially monopolise the market in the UK. Their product can be used for plastic bags, bottles, packaging, nappies etc etc. I mean.. how many nappies do kids use a day.. a week.. a year.. that's a lot of crap that stanelco can turn into cash.

Anyway. What else is there? Oh yeah I've began searching for companies exclusively engaged in producing, refining or researching organic/100% biofuels. I read an article.. that's a lie it was a TV show highlighting impact of the modern world on traditional agriculture. Anyway the underlying message was that biofuels are an essential development criteria for the coming decades. A long term punt on some research could net a great deal of moolah for a BioMW in 30 years.

The question is: With BP/Shell/Random Oil Company making so much money on oil - which company with the facilities or infrastructure is going to spend time and money developing something which might not make much money for the next 30 years? If I was at BP I would suggest taking £1bn (less than 10% of a years profit), buy a million acres of wheat-farmable land and just have a go. Then I'd get sacked lol.

Green is the future, how we make money out of it is the present.

Posted on 3/10/2008 02:09:00 pm

What an anti-climax this morning. Decent jump from ASG this morning, profit over £60 but since then ASG and SEO have just been moving sideways. RNS from ASG tomorrow so we'll see where we are with that - there's a few contract rumours and acquisition chat going about. I'll probably sell this stock this week - not really exciting enough in the short term.

Friday is the day for SEO - looking sexual at the moment. Market makers seemed to have cooled it after forcing so many people out. Looking for 2p by next week but we'll see eh? Got a brilliant looking watch list now - a few of the originals are doing what I thought they would, and have also given some strong buy signals lately. I have noticeably began to look at AIM/penntstocks/small caps and paying little attention to FTSE100 except for BARC.

In other news, betfair poker is proving to be an excellent stomping ground. I've doubled up my initial deposit and withdrew that so I'm playing on profit and gradually increasing. The players leave a lot to be desired (some call $2 on the river with a pair of 2s or 3s - it's happened loads) so looking for some steady wins and good bankroll management here. Still on the small stakes just now. Tournaments are a little harder so have put them on the backburner until my bankroll is a little more flush. Tight-aggresive is really the best method here, only calling/raising preflop with high pocket pairs, AK QJ flushed etc.

I've also started STBs (sure thing bets) which is so so lame and sad you have no idea! Basically it's just plain sports betting, but on a near guranteed result - if Arsenal are up 4-0 at half time - they're not losing are they? The gains are minute, but every little helps. I won .. lol, 40p this morning on betting the FTSE would end the hour up just by looking at the chart it was obvious - 40p for a £2 stake isn't all the bad I suppose - what's that, 20% ok not too bad I guess!

Posted on 3/07/2008 04:45:00 pm

Labels:

About TSLR

Update 2 of the about me section as it's been ages again.

I'm a mechanical engineering student trading some student loan money, this blog documents my exploits as I learn the ropes. I've had a passive interest in the money markets for quite a while, and after reading a few books and doing a lot of research online, decided to put my money on the table in an attempt to become successful in this game.

I've been blogging/trading since late February 2008. If you read my early posts you will cringe at how naive I was - but this is all part of the process. A few big wins, and some substantial losses later, here I am trading in the most difficult climate in decades.

I trade from home when college allows (usually 2 full days, and some evenings). I trade US equities exclusively, however recently I have began analysis of forex markets and have opened a demo account. I trade CFDs through CMC Markets, and although this is not my ideal trading setup, it has to do for now. My FX demo account is with FXCM.

I am a technical trader, almost 100%. I focus on simple chart patterns with attention to moving averages and volume. Before the market meltdown, I was a swing trader that focused on setups ranging from 3-7 days. Given what this crisis has done to the charts, I focus on a much shorter time frame, and no longer use stochastics/macd.

While trading during the day, I pay close attention to the market internals and the S&P 500. I watch TRIN, TICK and IINA/D (depending on sentiment) to time my entries.

I have a strict set of trading rules which I stick to very well. I have developed these rules over the past few months, and they have formed the foundations for my strategies. Prior to these rules I was very inconsistent and I am now beginning carve out an edge.

My risk management rules also help me with my rules. I risk 1.5% of total account value per trade, and work out my position size from there using a spreadsheet I have developed (search the blog), that also tracks my trades and gives me important statistics. My risk reward ratio per trade must be greater than 3.

Trading is taking up a lot of my time at the moment, but outside of it I've got college and all the baggage that goes with it. I hang out with my mates, play football (and pro ev), listen to all sorts of music but mostly electro. I also like to pump iron at the gym like my main man Arnold Schwarzenegger and am a bit of a health food freak.

Thanks for reading and boosting my hits!

TSLR.

Posted on 3/07/2008 04:45:00 pm

Oi Oi. Well, a fairly boring day at college today so came home looking for some excitement. SEO did what I thought it would today, I guessed the price right each time I checked so fairly happy with that. When I came back.. well, I jumped on and spotted a ramp opportunity on ASG. I have absolutely no idea what they do but historically.. it looked like a great buy so I got in for 4.35 and then again at 4.5.

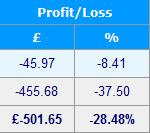

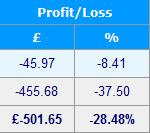

Monday morning will be the big one as far as I'm concerned. Perhaps I'm in way too deep.. seem to be spending a lot of time looking at charts and numbers and all sorts of stuff.. but oh well. Anyway, still deep deep in the red for SEO but next week.. we'll see. Exact same scenario with ASG, either I could double up next week or go totally bust. Anyway here's an interesting picture from just after I bought ASG and it went down a tad, I topped up, then it went up so here's the two sets of pictures of my portfolio - scary reading!

I'm not sure why I can't put them side by side but who cares. The point I'm trying to make is the same one I attempted to make to my classmates. They all consider this stuff gambling (it's worse than poker apparently! lol). But you have to spend money to make money, and you have to be willing to put it all on the line otherwise you should just buy a unit trust or a managed fund or dump it in a spank. £80 is a lot to some of them, but that was lost and gained back within 3 minutes. Potentially I could make £500 on Monday.. potentially I could lose my entire portfolio. Either way I wouldn't make the £500 without risking my portfolio. You don't win a hand at poker without betting, and you don't get anything out of life unless you put some effort into it.

I've also learned I'm entitled to £1000 travel expenses while at college which is good. I was thinking of offsetting that against any potential loss - or investing when I get it.. if it arrives. I sold RBS (what a dog of a share) today for a £80 loss to pump money into ASG and SEO. If these give me good profits I will be back in to RBS and maybe even SFR for long term. SFR is down to less than what I bought it now I think so good sell yesterday. If anyone is reading this and has a spare 2-300 pounds then buy some BARC, HBOS or RBS for a childs nest egg.

Posted on 3/06/2008 08:38:00 am

Stock update: sold SFR this morning to jump on the SEO train. Made a puny profit because it was just stagnant again. I will re-invest if I get a bit of profit of SEO. The question is, did I get in on time with SEO? Time will tell, needless to say the adrenalin is pumping this morning!

Update: 18:47

Mercy mercy me. What a rush this stocktrading is. I mean.. I haven't done herion by f* it must be something like it. Despair to joy then exponential despair within 10 seconds. Anyway I bought into SEO at 1.25p, and about half an hour later the ass just fell right out of it. I mean totally - it went down to .65p (just under a 50% loss) within about half an hour. And within that time I was £600 down. Crazy. Anyway, I guessed it was those market movers shaking the tree, forcing all the stop loss' to sell so they could mug them of their shares. Insane sell volumes.. good stuff to watch if you don't have the shares but I did and I was so close to selling. But I figure.. it's kind of free money and only a 5th of the total loan so let's ride out the storm, I've got balls.. fight or flight and all that stuff. I pumped in another £250 with my non-loan cash at .78p which with hindsight looks like a good decision. Mind you I'll replace that when my loan money comes in tomorrow.

My brother sold out for a £500 loss (finished on £3000, at one point he had £4000 for a £1k swing) so yeah. Anyway I held on and it's climbed up to .95p.. hopefully it will rise steadily until the announcements next week. Great product I've got to add (retrospective research - I won't jump in like that again).

Penny stocks are volatile.. there's no 2 ways about it. You shouldn't buy a penny stock unless you're prepared to lose it all - I mean after all you're prepared to double it aren't you? I will watch this with great interest over the next few days. I hope I don't get egg on my face lol.

Easy come, easy go. Easy come back again ;)

Posted on 3/05/2008 04:43:00 pm

Just a boo hoo rant. My money is still tied in SFR and RBS while SEO, PRF and DES have all increased more than double since I eyed them up for purchase. Totally gutted. RBS should claw back slowly over time, but SFR is a bee-in-bonnet scenario. It just climbs all day, hits 315 then closes at just over 304. My plan for that tomorrow is sell when it peaks then buy back in low. Or just buy one of the other climbers.

My bro bought SEO today on a recommendation and it closed at it's high so should keep it's momentum for tomorrow. My next installment is due on the 7th, so I will be researching a stock to throw that into.

As for poker I have signed up with betfair. Initially their software wasn't the best but I'm into it now. Only playing on 5/10 tables, the players are a lot more timid and aren't just crazy idiots betting on rags. I'm up a few quid each hour session, so slow and steady wins the race. I will level up once I've doubled up my £12 deposit.

PS I really really hate the blogging software, particularly with font sizing, it just never works right.

Posted on 3/03/2008 01:57:00 pm

Just a little bit of interesting stuff from this morning. RBS is down again as predicted due to the US recession gossip and their markets slipping up on Friday. The range is low so we’ll see what happens up to the ex-div date on Wednesday. I’m expecting it to go down to around 355p before adjusting back to it’s real value.

Anyway, as for the media, well well well I say. HSBC was the last bank to report today.

- Operating income up 25% to US$97.6bn

- Annual profits to US£24.2bn

Really not bad at all fundamentally is it? Not if you’re the press. BBC headline “HSBC in $17bn credit crisis loss”. The small print read “But its annual profits still rose 10%”. Now this is why there is so much doom and gloom going around at the moment. It’s total garbage. Average Joe knows nothing about finance and reads this and thinks.. oh no, debt everywhere.. i’m going to lose my house.. stocks are for people with lots of money.. blah blah. What strikes me is that the headline should have read “HSBC profits up to 10% despite credit crunch losses”. That’s a much more optimistic headline that would encourage more confidence in the market. But the market movers will have it another way.

RBS is subject to more of the bad press. Citigroup, a rival, is always making the prices – why? They’re total balls compared to RBS. RBS went down in price on a good day for the market despite record profits. HSBC has gone up on a bad day because of less impressive news. I might be a slight bitter because my holding is down £30 lol, but there are people sitting somewhere just having a laugh. I really like that aspect but why should the UK sector be so pessimistic because American banks gave money to people under the poverty line?

SFR slumped a bit this morning but recovered and is finding its feet again. It’s amazing how tempted I am to sell to buy some other stocks but there’s no point really. I’d make the same gains from them that I would with SFR anyway. Desire Petroleum, despite the huge rise still looks a good prospect. I have also added KLR, ROC and IPR to my watch list. ROK is up 4.1% this afternoon and most of my watch list still looks quite good (speculators aside that is).

While guiding a Boa-Morte inspired Portugal to World Cup glory on Pro Ev last night I conjured up my re-investment plan for my money. Which is still a work in progress there go subject to change. It’s just for the anticipated profits of my £900+ equities holding. For the profits back, I will re-invest 60%, put 20% into an ING savings account, and keep 20% for miscellaneous misdemeanours. It seems good enough; I’m not really expecting any real gains in each trade. I’m aiming realistically for the portfolio to be worth in excess of £5500 by June. £500 isn’t much yet is double what I would expect to get through leaving it in a bank. This is all subject to change of course, dependant the medias point of view.

Posted on 3/01/2008 03:18:00 pm

This first post started on 25th feb so is backdated

Background info: I have read a lot of books over the years on the stockmarket, studied accounting at school then 2 years of economics at uni (I dropped out oh well). Others would say “don’t try this” but you can do whatever you want. Actually do it, and good on you if you do. In my opinion it is the absolute best way to make money and it’s really interesting. You also learn a lot as you go and you don’t have to be good at money, just analysis and chart reading. Anyway, if you aren’t into this and you’re British – read ‘One up on Wall Street – Peter Lynch’ and ‘Rich Dad, Poor Dad – Robert Kwhatshisfaceitsgood’. These books will change how you look at money no doubt. Fo sho’

Anyway, I won’t explain really what I’m doing as I go – It’s just a diary of what I’m trading.

Starting balance

£2000 premium bonds

£964 for stock/equities

Transaction one (24 Feb):

Severfield Rowen (SFR)

This was my first stock for the loan so well excited about this. Absolute rock solid fundamentals, and just had a huge crash for no real reason except profits are a slight below expectations. Decent dividends too but haven’t decided on whether to keep going on that. I bought 315 shares at 2.932. I was going to buy at 2.652 but my broker account wasn’t open :( boo hoo etc

That red dot is where I got in. My target price for a £100 profit is 330p, but with it’s current momentum and rises despite small volumes, I expect this stock to see little to no resistance until the 400p mark, when it hits 400 I will make £321 (34%) profit. However the timeline for this could be long and I have some exciting prospects on my watchlist such as Coal of Africa, Desire Petroluem and Rift Oil. This share was a great value buy and it could go back up to 500 longer term for £636 profit, but holding too long isn’t what I want with the bulk of my loan.

The Monday following SFR I received the first instalment of my loan (as in month by month from now). With that, I purchased 115 shares in The Royal Bank of Scotland at 400p. Reasons being that this is one hell of a company. They’re about to announce record profits, Qatari investment rumours and a decent dividend date in the not too distant future. The banking sector took a huge kick in the nuts, well, the whole FTSE took a huge kick in the nuts in Jan so this was a great opporchancity to snap up a solid company with good ratios on the cheap.

It was on my watch list with SFR and BARC for my first pick but opted for SFR looking for money gain over percentage which sounds crazy but hey. I intend to hold this long long term so don’t expect much news on this. Dividends will only net me around £22 quid, but that’s better than spending £22 on a bad CD and some drugs right? Anyway my target for this is 550p for £164 profit within the year, but I may hold until I’m an old man. My SFR money etc is for the real gains.

Update Feb 29:

SFR broke through the £3 resistance and is thrashing it’s way up towards 340. Hit 327p yesterday which is tantalizingly close to me profit taking point but has slowed down a bit and closed at 313p today. RBS on the other hand announced £10 billion profits up 10% on last year and a sizeable dividend increase – but it closed down -1.26%. Funny old world. However it’s a minor fall after hitting 426p yesterday so it’s an easy lover tonight and should bounce back next week. At it’s peak, this week I had earned £102 profit, we shall see what tomorrow brings though –Close the week at over £100. I doubt it!

Side note: Desire Petroleum (DES) is up more than double from when I added it to my watch list. May have missed the gravy train there but my japs eye is locked on that with interest. Also watching HBOS after a big slip despite a 3% profit increase.

After counting the beans this week I am up £24

Poker:

Poker sucks. Basically I’m a strong sit and go player but decided cash tables might be more economical – they’re not. Rule 1: You really have to up your price range if you want to make money. Putting in £5 and playing 3/6p blinds does not work. These guys are so bloody bad at poker it’s unreal, BUT, they will call anything and in the long term, they always luck out and hit something – usually the hand one up from yours. Playing at 25/50p blinds makes more sense; the higher quality of player will take their time, won’t tilt as much, and is a bit more worried about losing a few quid on a garbage call. Either way I’m not playing cash games. I’ll get back into sit and go’s after I raise enough capital to absorb a few losses on that (worst case scenario). If SFR pays out over £200 I will put £30 or so into a poker room. It won’t be William hill though I don’t like it anymore. I know poker is a game of skill but it’s just a gamble when you play shitty players, it really is.

March the 1st baby:

Well our one free day for the next 4 years has passed. I was hoping to attack the day and do something exciting but alas it was a Friday and therefore I was shackled up in the workshop at college, learned some more thermofluids then paid for my MOT.. oh shit.. damn it I just realised my road tax is out of date.. Anyway, that ain’t the point of my blog so here goes.

US markets down again on Friedegg so some pessimism surrounding the opening bell on Monday, particularly for RBS. That’s the general consensus, but in my opinion RBS will bounce back up over 4. I hope. Either that or it will find support at 360. But hey, ex-div on Wednesday so that’ll be £25 into the profits for the year.

I’m expecting SFR to really rally this next week. I am extremely tempted to sell out at my original target of 330p, but targets are for losers. My new target is in the 360-400 band, if it finds its historical resistance at around 400 again I will be out. 360 nets me just shy of £200 which for the first trade with this cash is acceptable. 400 on the other hand pushes that figure up to £320. Greed is a funny old thing so that will have to be curtailed in line with my long term objectives. 400p looks attainable as it closes the gap on the big fall, so the time frame has decreased in this holding which I’m pleased at.

Side not: my friend works for a company called Expro. I very nearly bought these stocks in December but decided against it as it was a real sideways mover and I was rusty on charts. I clocked onto it at 860p, yesterday a take over rumour shot it up to £12. Wonder if he’ll keep his jobe.

After some chart hopping I am watching these very closely on Monday:

HBOS, GPOR and WNER

I have also added the following to my general watch list depending on charts and speculation:

ROK, CLI, IRET, MCKS, ATC, CLN, WTI, SAFE, BDEV

Adding this for new logo