Looks like short selling has been banned more or less worldwide in the financials today. I've got a couple of opinions on this;

Firstly, in the UK at least, it was only the institutions that could actually go short in the first place. Therefore any profit they made from shorting stayed in the markets. That's just what happens when one bank attacks another when they short.

Speculators have not been forcing down the stock price, it's all to do with the global economy being in a dire state due to all the bad debts. Debt equals less free money, therefore the cogs of the free market and economy can't work as well as they normally do when banks etc can loan and receive money from each other.

This will have a significant short term boost in the financial sectors across the world, as people with short positions will have to close them. A massive short squeeze will put severe buying pressure in the market and should lead to some strong gains. Most of the market jumped over 10% yesterday towards the end, and this should follow into today.

Also like to say that this

Lloyds HBOS merger. Talk about a shotgun wedding - I think both are OK long term, and the risk to them will not decrease because they're merging. I am delighted with

Lloyds who I use. They have bought

HBOS for a song.

Anyway, today I will be focusing on trading the gap in the US financials this morning. I am looking at

AIG, WM, WB, C as well as the US Banking Sector

CFD and I will scalp out the S&P. The S&P is currently forming a double top leading into the market open in the short term, however this could really explode north by 50 points to 1300. It could also implode.. who knows in this market?

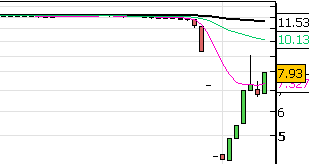

I have had one nice

pre-market trade in the S&P which was an easy setup. Here's the chart to let you know what I'm checking out at 13:37.

Update 17:20

Update 17:20Down on the day after having a great few opening hours. S&P got really really choppy and started to reverse on me instantly. Pulled the plug on today because it's not a good idea to keep doing that. I have learned a few things again today;

- Do not increase your position size because you have been running hot with consecutive winners.

- Do not make 15 open and close trades in 3 hours - horrific overtrading.

- It is not a good idea to close and reverse to open a new position with double the size.

It was all going nice until I started to increase my size, expose myself to more risk and closing and reversing with increased size. All of that just meant that as soon as I lost, I was instantly trying to claw the loss back - which is

definitely not a reason to enter a trade.

Also,

CMC have suspended trading pretty much every financial stock that is listed anywhere. The thing that really gets me about this is the fact that they are a bookmakers whose primary service is to provide a client with a contract for the difference in the price of an instrument. The

CFDs traded are a reflection of the price only, and the client does not buy or own any actual equity in a company thus not driving down the price.

It seems to me that

CMC are only doing this because they must be losing an absolute fortune at the moment, and good riddance because they are a bunch of *******. On a side note, the prices for the S&P contract that

CMC offer are constantly 3 points below the actual real-life value, which is very frustrating if you are working off different charts to gauge support and resistance.

Lots of news driving this market at the moment, I'm going to take a back seat until Monday and see what happens then. Hopefully I'll scam

CMC out of some more coin.

Update 20:30Goodbye free market. I tell you, I could not have picked a worse time to get into trading. It more or less seems now that the US government is blocking free trade. Who knows if anyone will actually be able to buy into a company anymore in 12 months time.

I've been following this guys blog recently, and he has hit the nail on the head with this post:

You know what, it doesn't really matter anymore.

The ratio is the risk:reward calculation. The system also predicts what it thinks the outcome will be, this is based on:

The ratio is the risk:reward calculation. The system also predicts what it thinks the outcome will be, this is based on:

The ratio is the risk:reward calculation. The system also predicts what it thinks the outcome will be, this is based on:

The ratio is the risk:reward calculation. The system also predicts what it thinks the outcome will be, this is based on: