[INTRA-DAY ACTION]

All is quiet on the Western front this morning, so I'll cover a few charts and news from Yesterday - which was another great day for trading. There is a lot of buoyancy in the markets at the moment, predominantly sparked by the crashing oil prices. The financials are picking up nicely, so the rest of the market is doing the same.

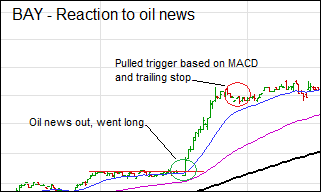

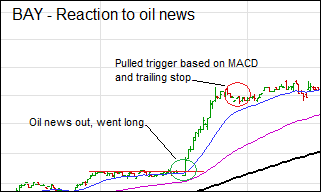

There was a tremendous rally in the states yesterday as the oil reserves were announced and were higher than anticipated - this briefly tilted the scales in favour of the supply side, thus sending the price lower.

Prior to the news I filled out some order tickets for BAY and TSO (Airline/Refiner), and got ready to hit either sell or buy. The news was good so I was long in BAY and TSO. TSO was a shorter term play, as it tends to react nicely and then tail off quite soon after. BAY traded nicely, I sold out due to my current rules - and would have tripled holding into this morning.

Here are a few charts from yesterday, X and C are very nice on a technical level.

I'm waiting for the post-lunch movements and the US market opening before getting into anything today. The S&P is really taking off pre-market so I expect some good trading in C and BAC today. I will also look to open positions in X and MON depending on their sectors.

I've started to notice something exploitable about SIE and NOK - they tend to move very slowly, and then make very explosive moves at the key decision points. There have been 2 times this week where all the factors have come down to a single point, and they have both rapidly gained over €1.

I was busy writing this blog when they made their moves today, so hopefully I will catch their moves next time.

There was a tremendous rally in the states yesterday as the oil reserves were announced and were higher than anticipated - this briefly tilted the scales in favour of the supply side, thus sending the price lower.

Prior to the news I filled out some order tickets for BAY and TSO (Airline/Refiner), and got ready to hit either sell or buy. The news was good so I was long in BAY and TSO. TSO was a shorter term play, as it tends to react nicely and then tail off quite soon after. BAY traded nicely, I sold out due to my current rules - and would have tripled holding into this morning.

Here are a few charts from yesterday, X and C are very nice on a technical level.

I'm waiting for the post-lunch movements and the US market opening before getting into anything today. The S&P is really taking off pre-market so I expect some good trading in C and BAC today. I will also look to open positions in X and MON depending on their sectors.

I've started to notice something exploitable about SIE and NOK - they tend to move very slowly, and then make very explosive moves at the key decision points. There have been 2 times this week where all the factors have come down to a single point, and they have both rapidly gained over €1.

I was busy writing this blog when they made their moves today, so hopefully I will catch their moves next time.

0 comments:

Post a Comment